On August 31st 2016, Dilma Rousseff became the first President of Brazil to be impeached, perhaps the culminating point of the political instability in a country plagued with corruption and cronyism. Only a few months before, in April, Argentina made the headlines by raising $16.5bn in a bond sale, the largest amount for an emerging economy at the time – only very recently eclipsed by the first sovereign bond issue in October by Saudi Arabia.

Who would have thought that, of the two rival countries, Argentina’s economy would be the more attractive and dynamic one? A large part of the recent change in opinion has to do with the election of the reformist Mauricio Marci, putting an end to more than a decade of rule by the Kirchner couple – first Néstor Kirchner from 2003 to 2007, then Christina Kirchner up to 2015. As of now, Argentina’s economy as a whole looks more stable than its neighbour and in better hands. But this has not always been the case.

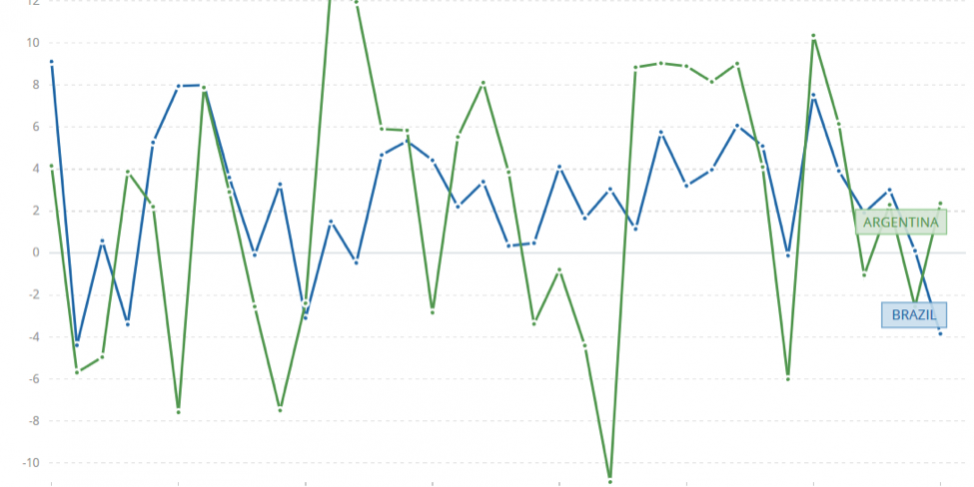

The Argentine economy is characterised by very high volatility with frequent bouts of recession (1981, 1985, 1989, 1995, 1999 to 2002, 2009, 2012 and 2014). A part of this volatility can be attributed to the heavy dependence on commodities, whose prices tend to fluctuate widely. However, such volatility based on agricultural and mining activities should also affect Brazil in roughly the same way. A common way to measure macroeconomic volatility is to use the standard deviation of the growth rate of a variable. Ramey and Ramey (1995) use the standard deviation of the growth rate of GDP per-capita. A similar method applied to Argentina and Brazil between 1980 and 2015 shows that the standard deviation of Argentina’s GDP per-capita growth rate (6.17) is almost twice as much as Brazil’s growth rate (3.23).

One possible explanation resides in the way both countries have interacted with the rest of the world. A retrospective into the economic history of Argentina and Brazil should prove useful. In the decades following the end of the Second World War, most South American countries chose to focus on developing their own domestic manufacturing industry in a strategy known as infant industry protection using Import Substitution Industrialisation (ISI). Initial success was followed by slowing growth – the manufacturing sector was too constrained by the size of the domestic market and suffered from inefficiency due to reduced competition, resulting in inflation and growing inequality.

Brazil chose to open up to the world, gearing its industry not towards domestic demand but towards foreign demand. The new export-oriented strategy owed its success to privatisations and broader openness to foreign capital flows and, above all, to the reduction of inflation. The combination in the mid-90s of high interest rates and the Real plan, which pegged the Brazilian currency to the US dollar, finally managed to tame hyperinflation. Annual inflation at that time had reached 2600%, putting considerable strain on the economy and on consumption. The peg lasted only a few years, unable to withstand the multiple crises at the end of the 1990s: the Asian crisis and the Russian default amongst others. The breaking of the peg resulted in a harsh devaluation of the Real. This was coupled with austerity measures that, however hard, seemed to pave the way for the high levels of growth seen under President Lula’s mandate.

The similarities with Argentina in this period are striking, and the differences in behaviour few. Just like Brazil, Argentina was plagued by hyperinflation and high level of debt. It responded in 1991 with a hard peg its currency to the US dollar, the first country in the region to do so. Argentina’s leaders followed the recommendations of the International Monetary Fund (IMF) almost to the letter: liberalisation, privatisation, opening up to trade and foreign investments. Just as in Brazil, pressure grew on the economy and on the currency peg because of the Asian and Russian crises. What proved fundamentally different though was the higher level of Argentine debt, the stricter peg, and the timing. Brazil let go of its peg much sooner than Argentina leading to a 30% depreciation of the real in 1998. That meant that Argentina was much less competitive in its dealings with Brazil, its biggest trading partner, and with the rest of the world. Debt levels in Argentina continued to grow, trust in the financial system collapsed, and Argentina eventually defaulted on its external debt at the very end of 2001. The currency peg disappeared soon after, amidst the economic turmoil, prompting a 75% decrease in the value of the Argentine peso.

The differences in the fundamentals of the economy were probably overstated, just as much as the issues surrounding the default payment. Argentina’s reputation of being a “pariah” in the financial markets has endured for more than a decade; a decade during which Argentina made do without access to the global financial market and with reluctance from foreign firms to invest in the country. As such, in 2014, foreign direct investment (FDI) to Brazil amounted to $73bn, 14 times as much as Argentina’s $5bn. Argentina has been mostly ostracised by investors and is conspicuously absent from the plethora of acronyms that have been coined to group the most promising emerging countries. From BRIC (2001), CIVETS (2009), or MINT (2013) there is no sign of the Argentine “A”.

Argentina and Brazil are long-time rivals, the two largest economies in South America, separated by language, by geopolitical tensions over the Paraná River and the number of stars on the jerseys of the national football team. By that account, Argentina and Brazil are also bound to be close partners; they have made great leaps by cooperating in the Mercosur, the South American free-trade area, and they almost seem to mirror each other in the political arena. After the long and successful – though much less favourably viewed – mandates of Lula and Néstor Kirchner came the mandates of Dilma Rousseff and Christina Kirchner, respectively the Chief of Staff and the wife of the previous presidents. The political situation today in both countries is at a turning point: Argentina has the opportunity under a reformist leader to rebrand itself and to shed its infamous reputation on the financial markets, whereas Michel Temer will have the tremendous task of restoring balance to Brazil’s ever-widening fiscal deficit.

The challenges are high. Mr Macri is desperate for some good news, some signs that his liberal programme is bearing fruit. Meanwhile, inflation in Argentina is on the up again, rekindling the spectre of hyperinflation. Mr Temer has, for now, the favours of the business leaders and of the policy-makers, but is still weighed down by his lack of legitimacy. Neither man should expect a rapid improvement of the economic situation in their country: the IMF forecasts -1% real GDP growth in 2017 for Argentina and -3.8% for Brazil. The economic history of the region is rife with ups and downs, even more so than the rest of the world. It is far too soon to express excessive optimism, but it is a promising start.