Thursday 26th February 2015 – Day 1

Click here for the Day 2 agenda

08:00 - Registration & Refreshments

These will be served in the lobby of the hotel.

09:00 - LSE EMF 2015 - Opening Remarks

Craig Calhoun - Director, LSE Professor Calhoun is a world-renowned social scientist whose work connects sociology to culture, communication, politics, philosophy and economics.

He took up his post as LSE Director on 1 September 2012, having left the United States where he was University Professor at New York University and director of the Institute for Public Knowledge and President of the Social Science Research Council.

Professor Calhoun took a D Phil in History and Sociology at Oxford University and a Master's in Social Anthropology at Manchester. He co-founded, with Richard Sennett, Professor of Sociology at LSE, the NYLON programme which brings together graduate students from New York and London for co-operative research programmes.

He is the author of several books including 'Nations Matter, Critical Social Theory, Neither Gods Nor Emperors' and most recently 'The Roots of Radicalism' (University of Chicago Press, 2012).

Professor Calhoun is a world-renowned social scientist whose work connects sociology to culture, communication, politics, philosophy and economics.

He took up his post as LSE Director on 1 September 2012, having left the United States where he was University Professor at New York University and director of the Institute for Public Knowledge and President of the Social Science Research Council.

Professor Calhoun took a D Phil in History and Sociology at Oxford University and a Master's in Social Anthropology at Manchester. He co-founded, with Richard Sennett, Professor of Sociology at LSE, the NYLON programme which brings together graduate students from New York and London for co-operative research programmes.

He is the author of several books including 'Nations Matter, Critical Social Theory, Neither Gods Nor Emperors' and most recently 'The Roots of Radicalism' (University of Chicago Press, 2012).

Professor Calhoun is a world-renowned social scientist whose work connects sociology to culture, communication, politics, philosophy and economics.

He took up his post as LSE Director on 1 September 2012, having left the United States where he was University Professor at New York University and director of the Institute for Public Knowledge and President of the Social Science Research Council.

Professor Calhoun took a D Phil in History and Sociology at Oxford University and a Master's in Social Anthropology at Manchester. He co-founded, with Richard Sennett, Professor of Sociology at LSE, the NYLON programme which brings together graduate students from New York and London for co-operative research programmes.

He is the author of several books including 'Nations Matter, Critical Social Theory, Neither Gods Nor Emperors' and most recently 'The Roots of Radicalism' (University of Chicago Press, 2012).

Professor Calhoun is a world-renowned social scientist whose work connects sociology to culture, communication, politics, philosophy and economics.

He took up his post as LSE Director on 1 September 2012, having left the United States where he was University Professor at New York University and director of the Institute for Public Knowledge and President of the Social Science Research Council.

Professor Calhoun took a D Phil in History and Sociology at Oxford University and a Master's in Social Anthropology at Manchester. He co-founded, with Richard Sennett, Professor of Sociology at LSE, the NYLON programme which brings together graduate students from New York and London for co-operative research programmes.

He is the author of several books including 'Nations Matter, Critical Social Theory, Neither Gods Nor Emperors' and most recently 'The Roots of Radicalism' (University of Chicago Press, 2012).

Describing his own approach to academic work, Professor Calhoun says: "We must set high standards for ourselves, but in order to inform the public well, not to isolate ourselves from it."

09:20 - Keynote

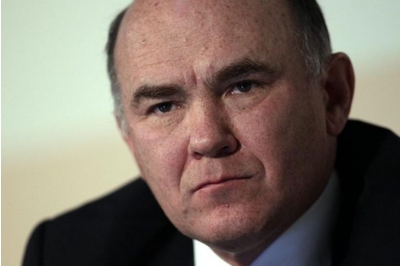

Ian Taylor – CEO, Vitol

As president and chief executive officer of Vitol, one of the world’s largest energy trading companies, Ian Taylor oversees a company that is deeply involved in the physical movement of almost every type of energy commodity worldwide. Vitol traded more than 260 million metric tons of oil and oil products in 2012, and at any one moment the company has more than 200 ships at sea, transporting everything from jet fuel and gasoline to coal and liquefied natural gas.

Mr. Taylor joined Vitol in 1985 and has been running the company since 1995. Under his leadership the privately held company has grown significantly in both scope and scale, yet it remains much like the man himself—agile, quick-thinking, alert to opportunities in every corner of the globe, and intimately familiar with the unique dynamics of energy markets.

(Source: Futures Industry)

10:00 - Panel Discussion: Private Equity in Emerging Markets

Mark Richards – Partner and Head of Financial Services, Actis Mark Richards’ interest in emerging markets began early in his career. At just 22, he was posted by Barclays to work in Zambia; a secondment that sparked a fascination with the continent, its people and the issues facing it. And when he eventually returned to London, he vowed that one day he would work in Africa again.

Some 18 very successful years followed for Mr. Richards at Barclays as Strategy Director, Corporate Development Director and Chief Financial Officer of International Banking and in 2005 he joined Actis to lead Actis' Financial Services team. Although based in London, he now has an extraordinary window not just on Africa, but on all the emerging markets.

Playing a part in this fast changing world is something Mr. Richards regards as a true privilege. But for him, supporting growth across these diverse cultures is not just about building better businesses; it’s about building better societies and setting the positive power of capital into motion day in, day out.

(Source: Actis)

Mark Richards’ interest in emerging markets began early in his career. At just 22, he was posted by Barclays to work in Zambia; a secondment that sparked a fascination with the continent, its people and the issues facing it. And when he eventually returned to London, he vowed that one day he would work in Africa again.

Some 18 very successful years followed for Mr. Richards at Barclays as Strategy Director, Corporate Development Director and Chief Financial Officer of International Banking and in 2005 he joined Actis to lead Actis' Financial Services team. Although based in London, he now has an extraordinary window not just on Africa, but on all the emerging markets.

Playing a part in this fast changing world is something Mr. Richards regards as a true privilege. But for him, supporting growth across these diverse cultures is not just about building better businesses; it’s about building better societies and setting the positive power of capital into motion day in, day out.

(Source: Actis)

Henry Obi - COO and Partner, Helios Investment Partners Mr. Henry Obi serves as the Chief Operating Officer and Partner at Helios Investment Partners LLP. Previously, Mr. Obi was a Partner and Portfolio Investments at Aureos Capital Limited. He was responsible for portfolio management and reporting. Prior to Aureos Capital Management, he was a Senior Investment Executive at Actis. Mr. Obi previously worked at CDC Assets for two years and was responsible for the US $100 million power portfolio and exploring securitizing CDC Assets’ US $150 million mezzanine loan portfolio. He spent two years with the Power Group as a Senior Executive focused on Investments. He started his investment career in the power investment team at CDC and has also worked at Actis and Dynegy. Mr. Obi serves as the Chairman of Africa Council of the Emerging Markets Private Equity Association. He serves as a Member of Advisory Board of Maris Capital Ltd. and is a Director of African Private Equity and Venture Capital Association. He has served on the Boards of Directors of Zambia Capital Partners (Zambia) and Central America Investment Managers (Mauritius). Mr. Obi received an M.B.A. from the London Business School and a B.Arch. from Nottingham University.

(Source: Bloomberg)

Mr. Henry Obi serves as the Chief Operating Officer and Partner at Helios Investment Partners LLP. Previously, Mr. Obi was a Partner and Portfolio Investments at Aureos Capital Limited. He was responsible for portfolio management and reporting. Prior to Aureos Capital Management, he was a Senior Investment Executive at Actis. Mr. Obi previously worked at CDC Assets for two years and was responsible for the US $100 million power portfolio and exploring securitizing CDC Assets’ US $150 million mezzanine loan portfolio. He spent two years with the Power Group as a Senior Executive focused on Investments. He started his investment career in the power investment team at CDC and has also worked at Actis and Dynegy. Mr. Obi serves as the Chairman of Africa Council of the Emerging Markets Private Equity Association. He serves as a Member of Advisory Board of Maris Capital Ltd. and is a Director of African Private Equity and Venture Capital Association. He has served on the Boards of Directors of Zambia Capital Partners (Zambia) and Central America Investment Managers (Mauritius). Mr. Obi received an M.B.A. from the London Business School and a B.Arch. from Nottingham University.

(Source: Bloomberg)

Sev Vettivetpillai - Partner, The Abraaj Group Sev Vettivetpillai is a Partner at The Abraaj Group where he is responsible for the Group’s sector focused Funds including Healthcare, Real Estate and Energy Infrastructure, as well as leading the efforts on launching new products and strategies.

Mr. Vettivetpillai is one of four permanent members of the Investment Committee responsible for approval of all Abraaj investments across the platform. In addition, he is Chairman of the Abraaj Partner’s Council and a Member of the Board of Directors.

Mr. Vettivetpillai has more than 20 years of experience within the growth markets private equity arena, with extensive experience in the areas of strategic investment management, fundraising, deal structuring, valuation, due diligence and portfolio management.

Mr. Vettivetpillai was Founder of the Aureos Group, where he held the position of Chief Executive Officer from 2003 until 2012, and Chief Investment Officer from 2001. He led the transaction for the acquisition of Aureos by The Abraaj Group in 2012.

Prior to joining Aureos, Mr. Vettivetpillai was a Senior Investment Executive at CDC Group plc between 1996-2001, after having served three years in CDC’s fund management company in Sri Lanka (Ayojana Fund Management) as an Investment Manager.

Mr. Vettivetpillai is a CFA Charter holder and completed a BEng (Hons) in Civil Engineering from Imperial College of Science, Technology and Medicine, UK.

Sev Vettivetpillai is a Partner at The Abraaj Group where he is responsible for the Group’s sector focused Funds including Healthcare, Real Estate and Energy Infrastructure, as well as leading the efforts on launching new products and strategies.

Mr. Vettivetpillai is one of four permanent members of the Investment Committee responsible for approval of all Abraaj investments across the platform. In addition, he is Chairman of the Abraaj Partner’s Council and a Member of the Board of Directors.

Mr. Vettivetpillai has more than 20 years of experience within the growth markets private equity arena, with extensive experience in the areas of strategic investment management, fundraising, deal structuring, valuation, due diligence and portfolio management.

Mr. Vettivetpillai was Founder of the Aureos Group, where he held the position of Chief Executive Officer from 2003 until 2012, and Chief Investment Officer from 2001. He led the transaction for the acquisition of Aureos by The Abraaj Group in 2012.

Prior to joining Aureos, Mr. Vettivetpillai was a Senior Investment Executive at CDC Group plc between 1996-2001, after having served three years in CDC’s fund management company in Sri Lanka (Ayojana Fund Management) as an Investment Manager.

Mr. Vettivetpillai is a CFA Charter holder and completed a BEng (Hons) in Civil Engineering from Imperial College of Science, Technology and Medicine, UK.

Henry Potter - Partner, Alpha Associates Henry Potter has been investing in companies, banks and private equity funds in eastern Europe since 1994. Henry is a Partner at Alpha Associates, responsible for investing Alpha’s eastern European private equity funds of funds. Henry joined Alpha Associates in September 2008 from the European Bank for Reconstruction and Development (EBRD) in London. Since then Henry has led a number of Alpha fund primary and secondary investments as well as direct co-investments in the region, including a number of multi-asset private equity secondary transactions triggered by the financial crisis. During his 14 year EBRD career Henry was responsible for a series of investments that the EBRD made both in private equity funds as well as directly into financial institutions and companies in CEE and Russia/CIS. As Senior Banker, he helped to build EBRD’s private equity funds investment program into the largest in the region. In addition to his managerial and transactional responsibilities, he oversaw EBRD’s private equity performance data collection and analysis, the co-investment program between EBRD and its portfolio funds, and at different points EBRD’s financial sector activities in Slovenia, Slovakia and Georgia. Over his career, Henry has served on a number of corporate boards, fund advisory committees and fund investment committees for both Alpha and EBRD and has also supported various industry initiatives including as a member of the EVCA CEE Task Force and, most recently, Chairman of the EMPEA Regional Council for Russia, Turkey and CEE. Henry holds a B.A. and a M.Sc. from the McGill/London School of Economics.

Henry Potter has been investing in companies, banks and private equity funds in eastern Europe since 1994. Henry is a Partner at Alpha Associates, responsible for investing Alpha’s eastern European private equity funds of funds. Henry joined Alpha Associates in September 2008 from the European Bank for Reconstruction and Development (EBRD) in London. Since then Henry has led a number of Alpha fund primary and secondary investments as well as direct co-investments in the region, including a number of multi-asset private equity secondary transactions triggered by the financial crisis. During his 14 year EBRD career Henry was responsible for a series of investments that the EBRD made both in private equity funds as well as directly into financial institutions and companies in CEE and Russia/CIS. As Senior Banker, he helped to build EBRD’s private equity funds investment program into the largest in the region. In addition to his managerial and transactional responsibilities, he oversaw EBRD’s private equity performance data collection and analysis, the co-investment program between EBRD and its portfolio funds, and at different points EBRD’s financial sector activities in Slovenia, Slovakia and Georgia. Over his career, Henry has served on a number of corporate boards, fund advisory committees and fund investment committees for both Alpha and EBRD and has also supported various industry initiatives including as a member of the EVCA CEE Task Force and, most recently, Chairman of the EMPEA Regional Council for Russia, Turkey and CEE. Henry holds a B.A. and a M.Sc. from the McGill/London School of Economics.

Chair: Dr. Jeffrey Leonard - Chief Executive Officer and Founding Partner, Global Environment Fund

Mr. Leonard is the Chief Executive Officer and Co-Founder of Global Environment Fund (GEF), one of the most experienced and most successful private equity firms dedicated exclusively to investments in the energy and environment sectors. Founded in 1990, GEF currently has approximately $1 billion in aggregate capital under management.

GEF invests in clean energy, gas distribution, energy efficiency and forestry in the US, Africa, Latin America and South Asia. GEF provides growth capital to high-growth companies whose business activities are improving the production and efficiency of the clean energy and environmental sectors. In addition, GEF invests in real assets through its sustainable timberland program. Due to the nature of its investment strategies, GEF has been a leader in the integration and management of ESG issues into its entire investment management program. GEF was awarded the FT Sustainable Investor of the Year in 2009 and 2010.

Mr. Leonard is former Chairman of the Board of The Washington Monthly and Chairman of the Board of CityYear (Washington, D.C.). Mr. Leonard is a board member of the National Council for Science and the Environment (NCSE), Emerging Markets Private Equity Association (EMPEA) and the New America Foundation. He is a founding board member and Chairman Emeritus of the Board of Beacon House Community Ministry, a not-for-profit organization dedicated to improving the lives of children and their families in northeast Washington, D.C. He has previously served as co-chairman of the Clean Technology Venture Network.

Mr. Leonard is a graduate of Princeton (Ph.D.), London School of Economics (M.S. Econ) and Harvard College (B.A., magna cum laude). He is the author of five books and numerous technical articles relating to global environmental issues, international trade, energy production and technology development.

Mr. Leonard is the Chief Executive Officer and Co-Founder of Global Environment Fund (GEF), one of the most experienced and most successful private equity firms dedicated exclusively to investments in the energy and environment sectors. Founded in 1990, GEF currently has approximately $1 billion in aggregate capital under management.

GEF invests in clean energy, gas distribution, energy efficiency and forestry in the US, Africa, Latin America and South Asia. GEF provides growth capital to high-growth companies whose business activities are improving the production and efficiency of the clean energy and environmental sectors. In addition, GEF invests in real assets through its sustainable timberland program. Due to the nature of its investment strategies, GEF has been a leader in the integration and management of ESG issues into its entire investment management program. GEF was awarded the FT Sustainable Investor of the Year in 2009 and 2010.

Mr. Leonard is former Chairman of the Board of The Washington Monthly and Chairman of the Board of CityYear (Washington, D.C.). Mr. Leonard is a board member of the National Council for Science and the Environment (NCSE), Emerging Markets Private Equity Association (EMPEA) and the New America Foundation. He is a founding board member and Chairman Emeritus of the Board of Beacon House Community Ministry, a not-for-profit organization dedicated to improving the lives of children and their families in northeast Washington, D.C. He has previously served as co-chairman of the Clean Technology Venture Network.

Mr. Leonard is a graduate of Princeton (Ph.D.), London School of Economics (M.S. Econ) and Harvard College (B.A., magna cum laude). He is the author of five books and numerous technical articles relating to global environmental issues, international trade, energy production and technology development.

Mark Richards’ interest in emerging markets began early in his career. At just 22, he was posted by Barclays to work in Zambia; a secondment that sparked a fascination with the continent, its people and the issues facing it. And when he eventually returned to London, he vowed that one day he would work in Africa again.

Some 18 very successful years followed for Mr. Richards at Barclays as Strategy Director, Corporate Development Director and Chief Financial Officer of International Banking and in 2005 he joined Actis to lead Actis' Financial Services team. Although based in London, he now has an extraordinary window not just on Africa, but on all the emerging markets.

Playing a part in this fast changing world is something Mr. Richards regards as a true privilege. But for him, supporting growth across these diverse cultures is not just about building better businesses; it’s about building better societies and setting the positive power of capital into motion day in, day out.

(Source: Actis)

Mark Richards’ interest in emerging markets began early in his career. At just 22, he was posted by Barclays to work in Zambia; a secondment that sparked a fascination with the continent, its people and the issues facing it. And when he eventually returned to London, he vowed that one day he would work in Africa again.

Some 18 very successful years followed for Mr. Richards at Barclays as Strategy Director, Corporate Development Director and Chief Financial Officer of International Banking and in 2005 he joined Actis to lead Actis' Financial Services team. Although based in London, he now has an extraordinary window not just on Africa, but on all the emerging markets.

Playing a part in this fast changing world is something Mr. Richards regards as a true privilege. But for him, supporting growth across these diverse cultures is not just about building better businesses; it’s about building better societies and setting the positive power of capital into motion day in, day out.

(Source: Actis)Henry Obi - COO and Partner, Helios Investment Partners

Mr. Henry Obi serves as the Chief Operating Officer and Partner at Helios Investment Partners LLP. Previously, Mr. Obi was a Partner and Portfolio Investments at Aureos Capital Limited. He was responsible for portfolio management and reporting. Prior to Aureos Capital Management, he was a Senior Investment Executive at Actis. Mr. Obi previously worked at CDC Assets for two years and was responsible for the US $100 million power portfolio and exploring securitizing CDC Assets’ US $150 million mezzanine loan portfolio. He spent two years with the Power Group as a Senior Executive focused on Investments. He started his investment career in the power investment team at CDC and has also worked at Actis and Dynegy. Mr. Obi serves as the Chairman of Africa Council of the Emerging Markets Private Equity Association. He serves as a Member of Advisory Board of Maris Capital Ltd. and is a Director of African Private Equity and Venture Capital Association. He has served on the Boards of Directors of Zambia Capital Partners (Zambia) and Central America Investment Managers (Mauritius). Mr. Obi received an M.B.A. from the London Business School and a B.Arch. from Nottingham University.

(Source: Bloomberg)

Mr. Henry Obi serves as the Chief Operating Officer and Partner at Helios Investment Partners LLP. Previously, Mr. Obi was a Partner and Portfolio Investments at Aureos Capital Limited. He was responsible for portfolio management and reporting. Prior to Aureos Capital Management, he was a Senior Investment Executive at Actis. Mr. Obi previously worked at CDC Assets for two years and was responsible for the US $100 million power portfolio and exploring securitizing CDC Assets’ US $150 million mezzanine loan portfolio. He spent two years with the Power Group as a Senior Executive focused on Investments. He started his investment career in the power investment team at CDC and has also worked at Actis and Dynegy. Mr. Obi serves as the Chairman of Africa Council of the Emerging Markets Private Equity Association. He serves as a Member of Advisory Board of Maris Capital Ltd. and is a Director of African Private Equity and Venture Capital Association. He has served on the Boards of Directors of Zambia Capital Partners (Zambia) and Central America Investment Managers (Mauritius). Mr. Obi received an M.B.A. from the London Business School and a B.Arch. from Nottingham University.

(Source: Bloomberg)Sev Vettivetpillai - Partner, The Abraaj Group

Sev Vettivetpillai is a Partner at The Abraaj Group where he is responsible for the Group’s sector focused Funds including Healthcare, Real Estate and Energy Infrastructure, as well as leading the efforts on launching new products and strategies.

Mr. Vettivetpillai is one of four permanent members of the Investment Committee responsible for approval of all Abraaj investments across the platform. In addition, he is Chairman of the Abraaj Partner’s Council and a Member of the Board of Directors.

Mr. Vettivetpillai has more than 20 years of experience within the growth markets private equity arena, with extensive experience in the areas of strategic investment management, fundraising, deal structuring, valuation, due diligence and portfolio management.

Mr. Vettivetpillai was Founder of the Aureos Group, where he held the position of Chief Executive Officer from 2003 until 2012, and Chief Investment Officer from 2001. He led the transaction for the acquisition of Aureos by The Abraaj Group in 2012.

Prior to joining Aureos, Mr. Vettivetpillai was a Senior Investment Executive at CDC Group plc between 1996-2001, after having served three years in CDC’s fund management company in Sri Lanka (Ayojana Fund Management) as an Investment Manager.

Mr. Vettivetpillai is a CFA Charter holder and completed a BEng (Hons) in Civil Engineering from Imperial College of Science, Technology and Medicine, UK.

Sev Vettivetpillai is a Partner at The Abraaj Group where he is responsible for the Group’s sector focused Funds including Healthcare, Real Estate and Energy Infrastructure, as well as leading the efforts on launching new products and strategies.

Mr. Vettivetpillai is one of four permanent members of the Investment Committee responsible for approval of all Abraaj investments across the platform. In addition, he is Chairman of the Abraaj Partner’s Council and a Member of the Board of Directors.

Mr. Vettivetpillai has more than 20 years of experience within the growth markets private equity arena, with extensive experience in the areas of strategic investment management, fundraising, deal structuring, valuation, due diligence and portfolio management.

Mr. Vettivetpillai was Founder of the Aureos Group, where he held the position of Chief Executive Officer from 2003 until 2012, and Chief Investment Officer from 2001. He led the transaction for the acquisition of Aureos by The Abraaj Group in 2012.

Prior to joining Aureos, Mr. Vettivetpillai was a Senior Investment Executive at CDC Group plc between 1996-2001, after having served three years in CDC’s fund management company in Sri Lanka (Ayojana Fund Management) as an Investment Manager.

Mr. Vettivetpillai is a CFA Charter holder and completed a BEng (Hons) in Civil Engineering from Imperial College of Science, Technology and Medicine, UK.Henry Potter - Partner, Alpha Associates

Henry Potter has been investing in companies, banks and private equity funds in eastern Europe since 1994. Henry is a Partner at Alpha Associates, responsible for investing Alpha’s eastern European private equity funds of funds. Henry joined Alpha Associates in September 2008 from the European Bank for Reconstruction and Development (EBRD) in London. Since then Henry has led a number of Alpha fund primary and secondary investments as well as direct co-investments in the region, including a number of multi-asset private equity secondary transactions triggered by the financial crisis. During his 14 year EBRD career Henry was responsible for a series of investments that the EBRD made both in private equity funds as well as directly into financial institutions and companies in CEE and Russia/CIS. As Senior Banker, he helped to build EBRD’s private equity funds investment program into the largest in the region. In addition to his managerial and transactional responsibilities, he oversaw EBRD’s private equity performance data collection and analysis, the co-investment program between EBRD and its portfolio funds, and at different points EBRD’s financial sector activities in Slovenia, Slovakia and Georgia. Over his career, Henry has served on a number of corporate boards, fund advisory committees and fund investment committees for both Alpha and EBRD and has also supported various industry initiatives including as a member of the EVCA CEE Task Force and, most recently, Chairman of the EMPEA Regional Council for Russia, Turkey and CEE. Henry holds a B.A. and a M.Sc. from the McGill/London School of Economics.

Henry Potter has been investing in companies, banks and private equity funds in eastern Europe since 1994. Henry is a Partner at Alpha Associates, responsible for investing Alpha’s eastern European private equity funds of funds. Henry joined Alpha Associates in September 2008 from the European Bank for Reconstruction and Development (EBRD) in London. Since then Henry has led a number of Alpha fund primary and secondary investments as well as direct co-investments in the region, including a number of multi-asset private equity secondary transactions triggered by the financial crisis. During his 14 year EBRD career Henry was responsible for a series of investments that the EBRD made both in private equity funds as well as directly into financial institutions and companies in CEE and Russia/CIS. As Senior Banker, he helped to build EBRD’s private equity funds investment program into the largest in the region. In addition to his managerial and transactional responsibilities, he oversaw EBRD’s private equity performance data collection and analysis, the co-investment program between EBRD and its portfolio funds, and at different points EBRD’s financial sector activities in Slovenia, Slovakia and Georgia. Over his career, Henry has served on a number of corporate boards, fund advisory committees and fund investment committees for both Alpha and EBRD and has also supported various industry initiatives including as a member of the EVCA CEE Task Force and, most recently, Chairman of the EMPEA Regional Council for Russia, Turkey and CEE. Henry holds a B.A. and a M.Sc. from the McGill/London School of Economics.Chair: Dr. Jeffrey Leonard - Chief Executive Officer and Founding Partner, Global Environment Fund

Mr. Leonard is the Chief Executive Officer and Co-Founder of Global Environment Fund (GEF), one of the most experienced and most successful private equity firms dedicated exclusively to investments in the energy and environment sectors. Founded in 1990, GEF currently has approximately $1 billion in aggregate capital under management.

GEF invests in clean energy, gas distribution, energy efficiency and forestry in the US, Africa, Latin America and South Asia. GEF provides growth capital to high-growth companies whose business activities are improving the production and efficiency of the clean energy and environmental sectors. In addition, GEF invests in real assets through its sustainable timberland program. Due to the nature of its investment strategies, GEF has been a leader in the integration and management of ESG issues into its entire investment management program. GEF was awarded the FT Sustainable Investor of the Year in 2009 and 2010.

Mr. Leonard is former Chairman of the Board of The Washington Monthly and Chairman of the Board of CityYear (Washington, D.C.). Mr. Leonard is a board member of the National Council for Science and the Environment (NCSE), Emerging Markets Private Equity Association (EMPEA) and the New America Foundation. He is a founding board member and Chairman Emeritus of the Board of Beacon House Community Ministry, a not-for-profit organization dedicated to improving the lives of children and their families in northeast Washington, D.C. He has previously served as co-chairman of the Clean Technology Venture Network.

Mr. Leonard is a graduate of Princeton (Ph.D.), London School of Economics (M.S. Econ) and Harvard College (B.A., magna cum laude). He is the author of five books and numerous technical articles relating to global environmental issues, international trade, energy production and technology development.

Mr. Leonard is the Chief Executive Officer and Co-Founder of Global Environment Fund (GEF), one of the most experienced and most successful private equity firms dedicated exclusively to investments in the energy and environment sectors. Founded in 1990, GEF currently has approximately $1 billion in aggregate capital under management.

GEF invests in clean energy, gas distribution, energy efficiency and forestry in the US, Africa, Latin America and South Asia. GEF provides growth capital to high-growth companies whose business activities are improving the production and efficiency of the clean energy and environmental sectors. In addition, GEF invests in real assets through its sustainable timberland program. Due to the nature of its investment strategies, GEF has been a leader in the integration and management of ESG issues into its entire investment management program. GEF was awarded the FT Sustainable Investor of the Year in 2009 and 2010.

Mr. Leonard is former Chairman of the Board of The Washington Monthly and Chairman of the Board of CityYear (Washington, D.C.). Mr. Leonard is a board member of the National Council for Science and the Environment (NCSE), Emerging Markets Private Equity Association (EMPEA) and the New America Foundation. He is a founding board member and Chairman Emeritus of the Board of Beacon House Community Ministry, a not-for-profit organization dedicated to improving the lives of children and their families in northeast Washington, D.C. He has previously served as co-chairman of the Clean Technology Venture Network.

Mr. Leonard is a graduate of Princeton (Ph.D.), London School of Economics (M.S. Econ) and Harvard College (B.A., magna cum laude). He is the author of five books and numerous technical articles relating to global environmental issues, international trade, energy production and technology development.11:00 - Refreshments

This will be served in the lobby of the hotel.

11:20 - Keynote: What's it Going to Take to be Successful in our Future World?

Dr. Dambisa Moyo - Renowned Author; Board Member of SAB Miller, Barclays, Barricks Gold; One of TIME Magazine's “100 Most Influential People in the World” 2009 Dambisa Moyo is a marathon-running author and international economist who analyzes the macroeconomy and global affairs. She has travelled to more than 75 countries over the last decade, during which time she has developed a unique knowledge base on the political, economic, and financial workings of emerging economies, in particular the BRICs and the frontier economies in Asia, South America, Africa and the Middle East.

Her work examines the interplay between rapidly developing countries, international business, and the global economy, while highlighting the key opportunities for investment.

Ms. Moyo serves on the boards of Barclays Bank, the financial services group, SABMiller, the global brewer, and Barrick Gold, the global miner. She was an economist at Goldman Sachs, where she worked for nearly a decade, and was a consultant to the World Bank in Washington, D.C.

Ms. Moyo was named by TIME Magazine as one of the “100 Most Influential People in the World,” and to the World Economic Forum’s Young Global Leaders Forum. She is a member of the Atlantic Council, and the Directors Council of the Museum Of Modern Art (MOMA). She was awarded the 2013 Hayek Lifetime Achievement Award, named for the Nobel Prize winner and recipient of the Presidential Medal of Freedom, Friedrich Hayek. Dr. Moyo has been a participant at the Bilderberg Conference and the U.S. Federal Reserve Jackson Hole Conference. In addition, she serves on the World Economic Forum’s Network of Global Agenda Councils on Global Imbalances.

She is the author of the New York Times bestsellers Dead Aid: Why Aid is Not Working and How There is a Better Way for Africa and How the West Was Lost: Fifty Years of Economic Folly and the Stark Choices Ahead. Her third book, Winner Take All: China’s Race for Resources and What it Means for the World, was published in June 2012, and premiered at #13 on the New York Times bestseller list.

Ms. Moyo is a contributing editor to CNBC, the business and finance news network. Her writing regularly appears in economic and finance-related publications such as the Financial Times and the Wall Street Journal.

She completed a PhD in economics at Oxford University and holds a Masters degree from Harvard University. She completed an undergraduate degree in chemistry and an MBA in finance at American University in Washington, D.C.

Dambisa Moyo is a marathon-running author and international economist who analyzes the macroeconomy and global affairs. She has travelled to more than 75 countries over the last decade, during which time she has developed a unique knowledge base on the political, economic, and financial workings of emerging economies, in particular the BRICs and the frontier economies in Asia, South America, Africa and the Middle East.

Her work examines the interplay between rapidly developing countries, international business, and the global economy, while highlighting the key opportunities for investment.

Ms. Moyo serves on the boards of Barclays Bank, the financial services group, SABMiller, the global brewer, and Barrick Gold, the global miner. She was an economist at Goldman Sachs, where she worked for nearly a decade, and was a consultant to the World Bank in Washington, D.C.

Ms. Moyo was named by TIME Magazine as one of the “100 Most Influential People in the World,” and to the World Economic Forum’s Young Global Leaders Forum. She is a member of the Atlantic Council, and the Directors Council of the Museum Of Modern Art (MOMA). She was awarded the 2013 Hayek Lifetime Achievement Award, named for the Nobel Prize winner and recipient of the Presidential Medal of Freedom, Friedrich Hayek. Dr. Moyo has been a participant at the Bilderberg Conference and the U.S. Federal Reserve Jackson Hole Conference. In addition, she serves on the World Economic Forum’s Network of Global Agenda Councils on Global Imbalances.

She is the author of the New York Times bestsellers Dead Aid: Why Aid is Not Working and How There is a Better Way for Africa and How the West Was Lost: Fifty Years of Economic Folly and the Stark Choices Ahead. Her third book, Winner Take All: China’s Race for Resources and What it Means for the World, was published in June 2012, and premiered at #13 on the New York Times bestseller list.

Ms. Moyo is a contributing editor to CNBC, the business and finance news network. Her writing regularly appears in economic and finance-related publications such as the Financial Times and the Wall Street Journal.

She completed a PhD in economics at Oxford University and holds a Masters degree from Harvard University. She completed an undergraduate degree in chemistry and an MBA in finance at American University in Washington, D.C.

Dambisa Moyo is a marathon-running author and international economist who analyzes the macroeconomy and global affairs. She has travelled to more than 75 countries over the last decade, during which time she has developed a unique knowledge base on the political, economic, and financial workings of emerging economies, in particular the BRICs and the frontier economies in Asia, South America, Africa and the Middle East.

Her work examines the interplay between rapidly developing countries, international business, and the global economy, while highlighting the key opportunities for investment.

Ms. Moyo serves on the boards of Barclays Bank, the financial services group, SABMiller, the global brewer, and Barrick Gold, the global miner. She was an economist at Goldman Sachs, where she worked for nearly a decade, and was a consultant to the World Bank in Washington, D.C.

Ms. Moyo was named by TIME Magazine as one of the “100 Most Influential People in the World,” and to the World Economic Forum’s Young Global Leaders Forum. She is a member of the Atlantic Council, and the Directors Council of the Museum Of Modern Art (MOMA). She was awarded the 2013 Hayek Lifetime Achievement Award, named for the Nobel Prize winner and recipient of the Presidential Medal of Freedom, Friedrich Hayek. Dr. Moyo has been a participant at the Bilderberg Conference and the U.S. Federal Reserve Jackson Hole Conference. In addition, she serves on the World Economic Forum’s Network of Global Agenda Councils on Global Imbalances.

She is the author of the New York Times bestsellers Dead Aid: Why Aid is Not Working and How There is a Better Way for Africa and How the West Was Lost: Fifty Years of Economic Folly and the Stark Choices Ahead. Her third book, Winner Take All: China’s Race for Resources and What it Means for the World, was published in June 2012, and premiered at #13 on the New York Times bestseller list.

Ms. Moyo is a contributing editor to CNBC, the business and finance news network. Her writing regularly appears in economic and finance-related publications such as the Financial Times and the Wall Street Journal.

She completed a PhD in economics at Oxford University and holds a Masters degree from Harvard University. She completed an undergraduate degree in chemistry and an MBA in finance at American University in Washington, D.C.

Dambisa Moyo is a marathon-running author and international economist who analyzes the macroeconomy and global affairs. She has travelled to more than 75 countries over the last decade, during which time she has developed a unique knowledge base on the political, economic, and financial workings of emerging economies, in particular the BRICs and the frontier economies in Asia, South America, Africa and the Middle East.

Her work examines the interplay between rapidly developing countries, international business, and the global economy, while highlighting the key opportunities for investment.

Ms. Moyo serves on the boards of Barclays Bank, the financial services group, SABMiller, the global brewer, and Barrick Gold, the global miner. She was an economist at Goldman Sachs, where she worked for nearly a decade, and was a consultant to the World Bank in Washington, D.C.

Ms. Moyo was named by TIME Magazine as one of the “100 Most Influential People in the World,” and to the World Economic Forum’s Young Global Leaders Forum. She is a member of the Atlantic Council, and the Directors Council of the Museum Of Modern Art (MOMA). She was awarded the 2013 Hayek Lifetime Achievement Award, named for the Nobel Prize winner and recipient of the Presidential Medal of Freedom, Friedrich Hayek. Dr. Moyo has been a participant at the Bilderberg Conference and the U.S. Federal Reserve Jackson Hole Conference. In addition, she serves on the World Economic Forum’s Network of Global Agenda Councils on Global Imbalances.

She is the author of the New York Times bestsellers Dead Aid: Why Aid is Not Working and How There is a Better Way for Africa and How the West Was Lost: Fifty Years of Economic Folly and the Stark Choices Ahead. Her third book, Winner Take All: China’s Race for Resources and What it Means for the World, was published in June 2012, and premiered at #13 on the New York Times bestseller list.

Ms. Moyo is a contributing editor to CNBC, the business and finance news network. Her writing regularly appears in economic and finance-related publications such as the Financial Times and the Wall Street Journal.

She completed a PhD in economics at Oxford University and holds a Masters degree from Harvard University. She completed an undergraduate degree in chemistry and an MBA in finance at American University in Washington, D.C.12:00 - Networking Buffet Lunch

Lunch will be served in the lobby of the hotel.

13.00 - First Workshop Session

Strand A Cancer Healthcare in Emerging Markets: Erik Leksell – Partner, Elekta Erik Leksell has held a variety of Sales and Marketing roles for Elekta since 2009 in India, Indonesia & Hong Kong. His focus area has been developing and improving cancer care in Emerging Markets. Currently he works in South Africa as Managing Director for Elekta in Sub-Saharan Africa.

Prior to Elekta, he was working for IFC in Indonesia, introducing micro loans thru cell phones & running his investment company Silent Spring. Today, Silent Spring, consist of 15 companies in diversified sectors like Green Energy, IT-related sector, Art & Wine.

Mr. Leksell has a BSc (Hons) at the Univeristy of Bath in Politics and International Relations with focus on International Security & Terrorism.

Erik Leksell has held a variety of Sales and Marketing roles for Elekta since 2009 in India, Indonesia & Hong Kong. His focus area has been developing and improving cancer care in Emerging Markets. Currently he works in South Africa as Managing Director for Elekta in Sub-Saharan Africa.

Prior to Elekta, he was working for IFC in Indonesia, introducing micro loans thru cell phones & running his investment company Silent Spring. Today, Silent Spring, consist of 15 companies in diversified sectors like Green Energy, IT-related sector, Art & Wine.

Mr. Leksell has a BSc (Hons) at the Univeristy of Bath in Politics and International Relations with focus on International Security & Terrorism.

Strand B Oil and Gas Services: Richard Butland - Chairman, Influit; former Head of Merchant Banking, Goldman Sachs Richard Butland is Chairman of Influit and the former managing director in the Merchant Banking Division. He joined Goldman Sachs in 2000 as an associate in the UK Advisory Group. Richard was promoted to run UK M&A Advisory in 2007 and subsequently moved to the Merchant Banking Division to head its private equity activities in the UK and Natural Resources across Europe. He was named managing director in 2006.

Prior to joining the firm, Richard worked at IBJ Schroder Bank for two years and at PricewaterhouseCoopers for five years.

Richard earned a bachelor's degree from Victoria University of Wellington in 1992 and qualified as a chartered accountant in 1995.

Richard Butland is Chairman of Influit and the former managing director in the Merchant Banking Division. He joined Goldman Sachs in 2000 as an associate in the UK Advisory Group. Richard was promoted to run UK M&A Advisory in 2007 and subsequently moved to the Merchant Banking Division to head its private equity activities in the UK and Natural Resources across Europe. He was named managing director in 2006.

Prior to joining the firm, Richard worked at IBJ Schroder Bank for two years and at PricewaterhouseCoopers for five years.

Richard earned a bachelor's degree from Victoria University of Wellington in 1992 and qualified as a chartered accountant in 1995.

Erik Leksell has held a variety of Sales and Marketing roles for Elekta since 2009 in India, Indonesia & Hong Kong. His focus area has been developing and improving cancer care in Emerging Markets. Currently he works in South Africa as Managing Director for Elekta in Sub-Saharan Africa.

Prior to Elekta, he was working for IFC in Indonesia, introducing micro loans thru cell phones & running his investment company Silent Spring. Today, Silent Spring, consist of 15 companies in diversified sectors like Green Energy, IT-related sector, Art & Wine.

Mr. Leksell has a BSc (Hons) at the Univeristy of Bath in Politics and International Relations with focus on International Security & Terrorism.

Erik Leksell has held a variety of Sales and Marketing roles for Elekta since 2009 in India, Indonesia & Hong Kong. His focus area has been developing and improving cancer care in Emerging Markets. Currently he works in South Africa as Managing Director for Elekta in Sub-Saharan Africa.

Prior to Elekta, he was working for IFC in Indonesia, introducing micro loans thru cell phones & running his investment company Silent Spring. Today, Silent Spring, consist of 15 companies in diversified sectors like Green Energy, IT-related sector, Art & Wine.

Mr. Leksell has a BSc (Hons) at the Univeristy of Bath in Politics and International Relations with focus on International Security & Terrorism.Strand B Oil and Gas Services: Richard Butland - Chairman, Influit; former Head of Merchant Banking, Goldman Sachs

Richard Butland is Chairman of Influit and the former managing director in the Merchant Banking Division. He joined Goldman Sachs in 2000 as an associate in the UK Advisory Group. Richard was promoted to run UK M&A Advisory in 2007 and subsequently moved to the Merchant Banking Division to head its private equity activities in the UK and Natural Resources across Europe. He was named managing director in 2006.

Prior to joining the firm, Richard worked at IBJ Schroder Bank for two years and at PricewaterhouseCoopers for five years.

Richard earned a bachelor's degree from Victoria University of Wellington in 1992 and qualified as a chartered accountant in 1995.

Richard Butland is Chairman of Influit and the former managing director in the Merchant Banking Division. He joined Goldman Sachs in 2000 as an associate in the UK Advisory Group. Richard was promoted to run UK M&A Advisory in 2007 and subsequently moved to the Merchant Banking Division to head its private equity activities in the UK and Natural Resources across Europe. He was named managing director in 2006.

Prior to joining the firm, Richard worked at IBJ Schroder Bank for two years and at PricewaterhouseCoopers for five years.

Richard earned a bachelor's degree from Victoria University of Wellington in 1992 and qualified as a chartered accountant in 1995.

14.00 - Second Workshop Session

Strand C Agribusiness: Javier Uribarren - Principal Javier Uribarren is the Chief Investment Officer of W1 Capital. Javier has a very long and distinguished career in financial markets. He was previously an Investment Director at Stenham Advisors where he was the Portfolio Manager for the multi-award winning global macro funds. Prior to joining Stenham he worked at AIG, Barclays and AMP. Mr Uribarren holds a Bachelor in Actuarial Science and Statistics from City University in London. and Andrea Michelli-Lopez - Principal, W1 Capital

Javier Uribarren is the Chief Investment Officer of W1 Capital. Javier has a very long and distinguished career in financial markets. He was previously an Investment Director at Stenham Advisors where he was the Portfolio Manager for the multi-award winning global macro funds. Prior to joining Stenham he worked at AIG, Barclays and AMP. Mr Uribarren holds a Bachelor in Actuarial Science and Statistics from City University in London. and Andrea Michelli-Lopez - Principal, W1 Capital Andrea Michelli is the Head of Strategy and Marketing of W1 Capital. Ms. Michelli has 20 years of experience in investment banking and asset management. She was previously at Stenham Advisors where she was responsible for the emerging markets equity fund and managed an investor base of both institutions and family offices. Prior to joining Stenham she worked at BTG Pactual, Dresdner Kleinwort Benson and Citigroup. Ms. Michelli holds a MBA from SDA Bocconi in Milan, a Bachelor in Economics from Universidade de Sao Paulo (Brazil) and a Bachelor in Public Admnistration from FGV in Sao Paulo (Brazil).

Andrea Michelli is the Head of Strategy and Marketing of W1 Capital. Ms. Michelli has 20 years of experience in investment banking and asset management. She was previously at Stenham Advisors where she was responsible for the emerging markets equity fund and managed an investor base of both institutions and family offices. Prior to joining Stenham she worked at BTG Pactual, Dresdner Kleinwort Benson and Citigroup. Ms. Michelli holds a MBA from SDA Bocconi in Milan, a Bachelor in Economics from Universidade de Sao Paulo (Brazil) and a Bachelor in Public Admnistration from FGV in Sao Paulo (Brazil).

Strand D Wine Markets: David Farber - Managing Director, Monopole Wine Portfolio Management Ltd After 15 years in investment banking and asset management (BNP Paribas,Citigroup,…), David Farber became founding director of IG Wines, a wine investment company before launching Monopole Wine PM which now has offices in the UK, France and Switzerland.

Mr. Farber has a passion for wine and has been an avid collector for 16 years.

After 15 years in investment banking and asset management (BNP Paribas,Citigroup,…), David Farber became founding director of IG Wines, a wine investment company before launching Monopole Wine PM which now has offices in the UK, France and Switzerland.

Mr. Farber has a passion for wine and has been an avid collector for 16 years.

Javier Uribarren is the Chief Investment Officer of W1 Capital. Javier has a very long and distinguished career in financial markets. He was previously an Investment Director at Stenham Advisors where he was the Portfolio Manager for the multi-award winning global macro funds. Prior to joining Stenham he worked at AIG, Barclays and AMP. Mr Uribarren holds a Bachelor in Actuarial Science and Statistics from City University in London.

Javier Uribarren is the Chief Investment Officer of W1 Capital. Javier has a very long and distinguished career in financial markets. He was previously an Investment Director at Stenham Advisors where he was the Portfolio Manager for the multi-award winning global macro funds. Prior to joining Stenham he worked at AIG, Barclays and AMP. Mr Uribarren holds a Bachelor in Actuarial Science and Statistics from City University in London. Andrea Michelli is the Head of Strategy and Marketing of W1 Capital. Ms. Michelli has 20 years of experience in investment banking and asset management. She was previously at Stenham Advisors where she was responsible for the emerging markets equity fund and managed an investor base of both institutions and family offices. Prior to joining Stenham she worked at BTG Pactual, Dresdner Kleinwort Benson and Citigroup. Ms. Michelli holds a MBA from SDA Bocconi in Milan, a Bachelor in Economics from Universidade de Sao Paulo (Brazil) and a Bachelor in Public Admnistration from FGV in Sao Paulo (Brazil).

Andrea Michelli is the Head of Strategy and Marketing of W1 Capital. Ms. Michelli has 20 years of experience in investment banking and asset management. She was previously at Stenham Advisors where she was responsible for the emerging markets equity fund and managed an investor base of both institutions and family offices. Prior to joining Stenham she worked at BTG Pactual, Dresdner Kleinwort Benson and Citigroup. Ms. Michelli holds a MBA from SDA Bocconi in Milan, a Bachelor in Economics from Universidade de Sao Paulo (Brazil) and a Bachelor in Public Admnistration from FGV in Sao Paulo (Brazil).Strand D Wine Markets: David Farber - Managing Director, Monopole Wine Portfolio Management Ltd

After 15 years in investment banking and asset management (BNP Paribas,Citigroup,…), David Farber became founding director of IG Wines, a wine investment company before launching Monopole Wine PM which now has offices in the UK, France and Switzerland.

Mr. Farber has a passion for wine and has been an avid collector for 16 years.

After 15 years in investment banking and asset management (BNP Paribas,Citigroup,…), David Farber became founding director of IG Wines, a wine investment company before launching Monopole Wine PM which now has offices in the UK, France and Switzerland.

Mr. Farber has a passion for wine and has been an avid collector for 16 years.15:00 - Refreshments

This will be served in the lobby of the hotel

15:20 - Keynote: Beyond the BRICs: An Outlook on Future Growth Markets

Jim O’Neill - Departing Chairman of Goldman Sachs Asset Management Jim O'Neill is currently Chairing a formal Review into AMR (antimicrobial resistance) which will continue through to the Spring of 2016, when recommendations will be made as to how to solve this global challenge.

Until October 2014, he chaired the Cities Growth Commission in the UK, when it provided its final recommendations.

He is Honorary Chair of Economics at Manchester University. He is also a Visiting Research Fellow at the international economic think tank, Bruegel, and on the economic advisory board to the IFC, the investing arm of the World Bank.

Mr. O'Neill worked for Goldman Sachs from 1995 until April 2013, spending most of his time there as Chief Economist.

He's also the creator of the acronym “BRIC” and recently made a documentary series for the BBC entitled MINT:The Next Economic Giants.

He is one of the founding trustees of the UK educational charity, SHINE. Mr. O'Neill also serves on the board of ‘Teach for All’ and a number of other charities specialising in education and in September 2013, became a Non-Executive Director of the UK Government’s Department of Education.

Jim O'Neill is currently Chairing a formal Review into AMR (antimicrobial resistance) which will continue through to the Spring of 2016, when recommendations will be made as to how to solve this global challenge.

Until October 2014, he chaired the Cities Growth Commission in the UK, when it provided its final recommendations.

He is Honorary Chair of Economics at Manchester University. He is also a Visiting Research Fellow at the international economic think tank, Bruegel, and on the economic advisory board to the IFC, the investing arm of the World Bank.

Mr. O'Neill worked for Goldman Sachs from 1995 until April 2013, spending most of his time there as Chief Economist.

He's also the creator of the acronym “BRIC” and recently made a documentary series for the BBC entitled MINT:The Next Economic Giants.

He is one of the founding trustees of the UK educational charity, SHINE. Mr. O'Neill also serves on the board of ‘Teach for All’ and a number of other charities specialising in education and in September 2013, became a Non-Executive Director of the UK Government’s Department of Education.

Jim O'Neill is currently Chairing a formal Review into AMR (antimicrobial resistance) which will continue through to the Spring of 2016, when recommendations will be made as to how to solve this global challenge.

Until October 2014, he chaired the Cities Growth Commission in the UK, when it provided its final recommendations.

He is Honorary Chair of Economics at Manchester University. He is also a Visiting Research Fellow at the international economic think tank, Bruegel, and on the economic advisory board to the IFC, the investing arm of the World Bank.

Mr. O'Neill worked for Goldman Sachs from 1995 until April 2013, spending most of his time there as Chief Economist.

He's also the creator of the acronym “BRIC” and recently made a documentary series for the BBC entitled MINT:The Next Economic Giants.

He is one of the founding trustees of the UK educational charity, SHINE. Mr. O'Neill also serves on the board of ‘Teach for All’ and a number of other charities specialising in education and in September 2013, became a Non-Executive Director of the UK Government’s Department of Education.

Jim O'Neill is currently Chairing a formal Review into AMR (antimicrobial resistance) which will continue through to the Spring of 2016, when recommendations will be made as to how to solve this global challenge.

Until October 2014, he chaired the Cities Growth Commission in the UK, when it provided its final recommendations.

He is Honorary Chair of Economics at Manchester University. He is also a Visiting Research Fellow at the international economic think tank, Bruegel, and on the economic advisory board to the IFC, the investing arm of the World Bank.

Mr. O'Neill worked for Goldman Sachs from 1995 until April 2013, spending most of his time there as Chief Economist.

He's also the creator of the acronym “BRIC” and recently made a documentary series for the BBC entitled MINT:The Next Economic Giants.

He is one of the founding trustees of the UK educational charity, SHINE. Mr. O'Neill also serves on the board of ‘Teach for All’ and a number of other charities specialising in education and in September 2013, became a Non-Executive Director of the UK Government’s Department of Education.16:00 - Panel Discussion: Foreign Exchange and Macro Economic Investment Strategies

Kit Juckes - Head of FX Strategy, Societe Generale Kit Juckes joined the bank in early June 2010 as Global Head of Foreign Exchange Strategy. Kit was responsible for leading the expansion of the research on global forex strategy. Prior to Societe Generale, Mr. Juckes was at the ECU Group, a London-based currency management boutique, where he was Chief Economist. He was also Global Head of Research at RBS and has over 25 years' experience analysing financial markets. In his own words, 'I was born close enough to Eldoret to be slightly disappointed I can't run a marathon in anything like 2 hours. After that, I spent a lot of time in France, some in boarding school and then some in London, studying economics (though I seem to have spent an awful lot of time playing hockey, tennis and bridge, instead of studying). About a week before my finals I worked out that I really, really like economics, and some time later I worked out that what I am really interested in, is economic history. If I'd worked this out earlier I'd be an academic, and my wife and children would have deserted me…..'

(Source: Societe Generale, LinkedIn)

Kit Juckes joined the bank in early June 2010 as Global Head of Foreign Exchange Strategy. Kit was responsible for leading the expansion of the research on global forex strategy. Prior to Societe Generale, Mr. Juckes was at the ECU Group, a London-based currency management boutique, where he was Chief Economist. He was also Global Head of Research at RBS and has over 25 years' experience analysing financial markets. In his own words, 'I was born close enough to Eldoret to be slightly disappointed I can't run a marathon in anything like 2 hours. After that, I spent a lot of time in France, some in boarding school and then some in London, studying economics (though I seem to have spent an awful lot of time playing hockey, tennis and bridge, instead of studying). About a week before my finals I worked out that I really, really like economics, and some time later I worked out that what I am really interested in, is economic history. If I'd worked this out earlier I'd be an academic, and my wife and children would have deserted me…..'

(Source: Societe Generale, LinkedIn)

Bhanu Baweja - Head of Emerging Markets Cross Asset Strategy, UBS Bhanu Baweja is UBS' Global Head of cross asset EM strategy. Before moving into this role he ran global EM fixed income and FX strategy for the bank. UBS' EM Strategy team have been rated #1 in the 2014 Extel survey. In prior years UBS EM strategy they've been rated top 3 in the US and European Institutional Investor surveys and by in Asia Money Poll. Prior to joining UBS in July 2002, Mr. Baweja was the Head of Research for Asia ex Japan Economics and Strategy with IDEAglobal. He began his working life as a tutor with the Economics department at the London School of Economics.

Mr. Baweja holds an MSc in Finance and Economics from the London School of Economics, a Master's in Economics from the Delhi School of Economics, and BA (Hons) Economics from St Stephen's College, Delhi.

Bhanu Baweja is UBS' Global Head of cross asset EM strategy. Before moving into this role he ran global EM fixed income and FX strategy for the bank. UBS' EM Strategy team have been rated #1 in the 2014 Extel survey. In prior years UBS EM strategy they've been rated top 3 in the US and European Institutional Investor surveys and by in Asia Money Poll. Prior to joining UBS in July 2002, Mr. Baweja was the Head of Research for Asia ex Japan Economics and Strategy with IDEAglobal. He began his working life as a tutor with the Economics department at the London School of Economics.

Mr. Baweja holds an MSc in Finance and Economics from the London School of Economics, a Master's in Economics from the Delhi School of Economics, and BA (Hons) Economics from St Stephen's College, Delhi.

Peter Kisler - Portfolio Manager, North Asset Management

Guillaume Fonkenell - Founder, Pharo Management Guillaume Fonkenell is the founder of Pharo Management and is a member of the Risk Committee. He has extensive experience trading currencies, bonds and derivatives in developed and emerging markets. Prior to founding Pharo Management LLC in 2000, he was a Managing Director at Merrill Lynch in New York. During his four-year tenure at Merrill Lynch, he initiated and successfully managed two businesses. The first one, the Latin American Local Markets Trading Group, had the mandate to take positions in all currencies, bonds and derivatives in Latin America. The second one, the Global Credit Derivatives Group, focused on structuring highly sophisticated emerging markets transactions for American, European and Japanese investors. Prior to joining Merrill Lynch, Mr. Fonkenell was a Vice President at Bankers Trust in New York, where he traded interest rate swaps and options for four years. After one year as the senior swaps trader, he was promoted to head all interest rate options trading activities. At Bankers Trust, Mr. Fonkenell used his quantitative background to design, structure and trade the most complex derivative products. He holds Masters Degrees in both Civil Engineering and International Business from Ecole Nationale Des Ponts-Et-Chaussées in Paris, France. Mr. Fonkenell is also an alumnus of Ecole Polytechnique in Paris.

(Source: Pharo Management, The Hedge Fund Journal)

Guillaume Fonkenell is the founder of Pharo Management and is a member of the Risk Committee. He has extensive experience trading currencies, bonds and derivatives in developed and emerging markets. Prior to founding Pharo Management LLC in 2000, he was a Managing Director at Merrill Lynch in New York. During his four-year tenure at Merrill Lynch, he initiated and successfully managed two businesses. The first one, the Latin American Local Markets Trading Group, had the mandate to take positions in all currencies, bonds and derivatives in Latin America. The second one, the Global Credit Derivatives Group, focused on structuring highly sophisticated emerging markets transactions for American, European and Japanese investors. Prior to joining Merrill Lynch, Mr. Fonkenell was a Vice President at Bankers Trust in New York, where he traded interest rate swaps and options for four years. After one year as the senior swaps trader, he was promoted to head all interest rate options trading activities. At Bankers Trust, Mr. Fonkenell used his quantitative background to design, structure and trade the most complex derivative products. He holds Masters Degrees in both Civil Engineering and International Business from Ecole Nationale Des Ponts-Et-Chaussées in Paris, France. Mr. Fonkenell is also an alumnus of Ecole Polytechnique in Paris.

(Source: Pharo Management, The Hedge Fund Journal)

Chair: Simon Kennedy - Chief International Economics Correspondent, Bloomberg Simon Kennedy is chief international economics correspondent at Bloomberg News in London. He previously covered the European economy from Paris and U.S. economic policy in Washington. He is a regular contributor to Bloomberg Businessweek and Bloomberg Markets magazines, based in London; has reported from more than two dozen countries.

Mr. Kennedy studied at City University, London and Concordia University, Montreal.

(Source: World Economic Forum)

Simon Kennedy is chief international economics correspondent at Bloomberg News in London. He previously covered the European economy from Paris and U.S. economic policy in Washington. He is a regular contributor to Bloomberg Businessweek and Bloomberg Markets magazines, based in London; has reported from more than two dozen countries.

Mr. Kennedy studied at City University, London and Concordia University, Montreal.

(Source: World Economic Forum)

Kit Juckes joined the bank in early June 2010 as Global Head of Foreign Exchange Strategy. Kit was responsible for leading the expansion of the research on global forex strategy. Prior to Societe Generale, Mr. Juckes was at the ECU Group, a London-based currency management boutique, where he was Chief Economist. He was also Global Head of Research at RBS and has over 25 years' experience analysing financial markets. In his own words, 'I was born close enough to Eldoret to be slightly disappointed I can't run a marathon in anything like 2 hours. After that, I spent a lot of time in France, some in boarding school and then some in London, studying economics (though I seem to have spent an awful lot of time playing hockey, tennis and bridge, instead of studying). About a week before my finals I worked out that I really, really like economics, and some time later I worked out that what I am really interested in, is economic history. If I'd worked this out earlier I'd be an academic, and my wife and children would have deserted me…..'

(Source: Societe Generale, LinkedIn)

Kit Juckes joined the bank in early June 2010 as Global Head of Foreign Exchange Strategy. Kit was responsible for leading the expansion of the research on global forex strategy. Prior to Societe Generale, Mr. Juckes was at the ECU Group, a London-based currency management boutique, where he was Chief Economist. He was also Global Head of Research at RBS and has over 25 years' experience analysing financial markets. In his own words, 'I was born close enough to Eldoret to be slightly disappointed I can't run a marathon in anything like 2 hours. After that, I spent a lot of time in France, some in boarding school and then some in London, studying economics (though I seem to have spent an awful lot of time playing hockey, tennis and bridge, instead of studying). About a week before my finals I worked out that I really, really like economics, and some time later I worked out that what I am really interested in, is economic history. If I'd worked this out earlier I'd be an academic, and my wife and children would have deserted me…..'

(Source: Societe Generale, LinkedIn)Bhanu Baweja - Head of Emerging Markets Cross Asset Strategy, UBS

Bhanu Baweja is UBS' Global Head of cross asset EM strategy. Before moving into this role he ran global EM fixed income and FX strategy for the bank. UBS' EM Strategy team have been rated #1 in the 2014 Extel survey. In prior years UBS EM strategy they've been rated top 3 in the US and European Institutional Investor surveys and by in Asia Money Poll. Prior to joining UBS in July 2002, Mr. Baweja was the Head of Research for Asia ex Japan Economics and Strategy with IDEAglobal. He began his working life as a tutor with the Economics department at the London School of Economics.

Mr. Baweja holds an MSc in Finance and Economics from the London School of Economics, a Master's in Economics from the Delhi School of Economics, and BA (Hons) Economics from St Stephen's College, Delhi.

Bhanu Baweja is UBS' Global Head of cross asset EM strategy. Before moving into this role he ran global EM fixed income and FX strategy for the bank. UBS' EM Strategy team have been rated #1 in the 2014 Extel survey. In prior years UBS EM strategy they've been rated top 3 in the US and European Institutional Investor surveys and by in Asia Money Poll. Prior to joining UBS in July 2002, Mr. Baweja was the Head of Research for Asia ex Japan Economics and Strategy with IDEAglobal. He began his working life as a tutor with the Economics department at the London School of Economics.

Mr. Baweja holds an MSc in Finance and Economics from the London School of Economics, a Master's in Economics from the Delhi School of Economics, and BA (Hons) Economics from St Stephen's College, Delhi.Peter Kisler - Portfolio Manager, North Asset Management

Peter joined North Asset Managment in September 2010 and is the lead Portfolio Manager of the North Emerging Markets Fund. Peter has over 17 years of experience trading Emerging Markets. From 2006 to 2010, Peter was a Managing Director at Swiss Re, London, where he established and managed the emerging markets business, running a $3 billion balance sheet. From 1997 to 2006, Peter worked in Emerging Markets Fixed Income at Morgan Stanley in London, where he was an Executive Director from 2004. Throughout his career, Peter has focused on proprietary trading of various fixed income, FX and derivative instruments. Peter has a B.Sc. in Econometrics and Mathematical Economics from the London School of Economics.

Guillaume Fonkenell - Founder, Pharo Management

Guillaume Fonkenell is the founder of Pharo Management and is a member of the Risk Committee. He has extensive experience trading currencies, bonds and derivatives in developed and emerging markets. Prior to founding Pharo Management LLC in 2000, he was a Managing Director at Merrill Lynch in New York. During his four-year tenure at Merrill Lynch, he initiated and successfully managed two businesses. The first one, the Latin American Local Markets Trading Group, had the mandate to take positions in all currencies, bonds and derivatives in Latin America. The second one, the Global Credit Derivatives Group, focused on structuring highly sophisticated emerging markets transactions for American, European and Japanese investors. Prior to joining Merrill Lynch, Mr. Fonkenell was a Vice President at Bankers Trust in New York, where he traded interest rate swaps and options for four years. After one year as the senior swaps trader, he was promoted to head all interest rate options trading activities. At Bankers Trust, Mr. Fonkenell used his quantitative background to design, structure and trade the most complex derivative products. He holds Masters Degrees in both Civil Engineering and International Business from Ecole Nationale Des Ponts-Et-Chaussées in Paris, France. Mr. Fonkenell is also an alumnus of Ecole Polytechnique in Paris.

(Source: Pharo Management, The Hedge Fund Journal)

Guillaume Fonkenell is the founder of Pharo Management and is a member of the Risk Committee. He has extensive experience trading currencies, bonds and derivatives in developed and emerging markets. Prior to founding Pharo Management LLC in 2000, he was a Managing Director at Merrill Lynch in New York. During his four-year tenure at Merrill Lynch, he initiated and successfully managed two businesses. The first one, the Latin American Local Markets Trading Group, had the mandate to take positions in all currencies, bonds and derivatives in Latin America. The second one, the Global Credit Derivatives Group, focused on structuring highly sophisticated emerging markets transactions for American, European and Japanese investors. Prior to joining Merrill Lynch, Mr. Fonkenell was a Vice President at Bankers Trust in New York, where he traded interest rate swaps and options for four years. After one year as the senior swaps trader, he was promoted to head all interest rate options trading activities. At Bankers Trust, Mr. Fonkenell used his quantitative background to design, structure and trade the most complex derivative products. He holds Masters Degrees in both Civil Engineering and International Business from Ecole Nationale Des Ponts-Et-Chaussées in Paris, France. Mr. Fonkenell is also an alumnus of Ecole Polytechnique in Paris.

(Source: Pharo Management, The Hedge Fund Journal)Chair: Simon Kennedy - Chief International Economics Correspondent, Bloomberg

Simon Kennedy is chief international economics correspondent at Bloomberg News in London. He previously covered the European economy from Paris and U.S. economic policy in Washington. He is a regular contributor to Bloomberg Businessweek and Bloomberg Markets magazines, based in London; has reported from more than two dozen countries.

Mr. Kennedy studied at City University, London and Concordia University, Montreal.

(Source: World Economic Forum)

Simon Kennedy is chief international economics correspondent at Bloomberg News in London. He previously covered the European economy from Paris and U.S. economic policy in Washington. He is a regular contributor to Bloomberg Businessweek and Bloomberg Markets magazines, based in London; has reported from more than two dozen countries.

Mr. Kennedy studied at City University, London and Concordia University, Montreal.

(Source: World Economic Forum)17:00 - Keynote: Healthcare in Emerging Markets

Sir Andrew Witty - CEO, GlaxoSmithKline Sir Andrew Witty became Chief Executive Officer of GlaxoSmithKline plc on 21 May 2008. He is a member of the Board and Corporate Executive Team.

Sir Andrew joined Glaxo in 1985 and has held a variety of Sales and Marketing roles in the UK and abroad including working in the Company’s International New Products groups, both in the Respiratory and HIV/Infectious disease fields. Outside of the UK, he has worked in South Africa, the USA and Singapore where he led the Group’s operations as Senior Vice President, Asia Pacific. While in Singapore Sir Andrew was a Board Member of the Singapore Economic Development Board and the Singapore Land Authority. In 2003 he was awarded the Public Service Medal by the Government of Singapore and in August 2012 was also awarded the Public Service Star.

In 2003 he was appointed President of GSK Europe and joined GSK’s Corporate Executive Team.

Moreover, Sir Andrew has served in numerous advisory roles to Governments around the world including South Africa, Singapore, Guangzhou China and the UK, where he is currently a member of the Prime Minister’s Business Advisory Group. He was awarded a Knighthood for services to the economy and to the UK pharmaceutical industry in the 2012 New Year Honours List and, in 2014, was appointed to be a Business Ambassador for the UK Government.

Sir Andrew Witty is Chancellor of the University of Nottingham, a position he took up on 1 January 2013 and a Member of the Global Health Innovation Advisory Board, Imperial College, 2014.

Sir Andrew has a Joint Honours BA in Economics from the University of Nottingham.

Sir Andrew Witty became Chief Executive Officer of GlaxoSmithKline plc on 21 May 2008. He is a member of the Board and Corporate Executive Team.