The landslide election of Rodrigo Duterte on May 9th 2016, who garnered almost as much support as his next two rivals combined, has been in great part attributed to his tough stance on curbing criminality, promising to wage a war against criminals. Despite the criticisms of various media outlets on his disregard of extrajudicial killings, which earned him the moniker “The Punisher” by Time magazine, both the stock markets and the currency reacted positively to his victory. The PSE Composite Index climbed 7.5% from 6,991.87 on May 9th to 7,511.74 on May 16th a week later.

However, the honeymoon period has now come to an end, just as President Duterte delivered on his campaign slogan “Change is coming”. His comment that “[Obama is] a son of a bitch” on September 8th turned media attention to his erratic behaviour, and he has uttered numerous declarations over the past few months that point to a break in US cooperation, and a political, economic, military pivot towards China.

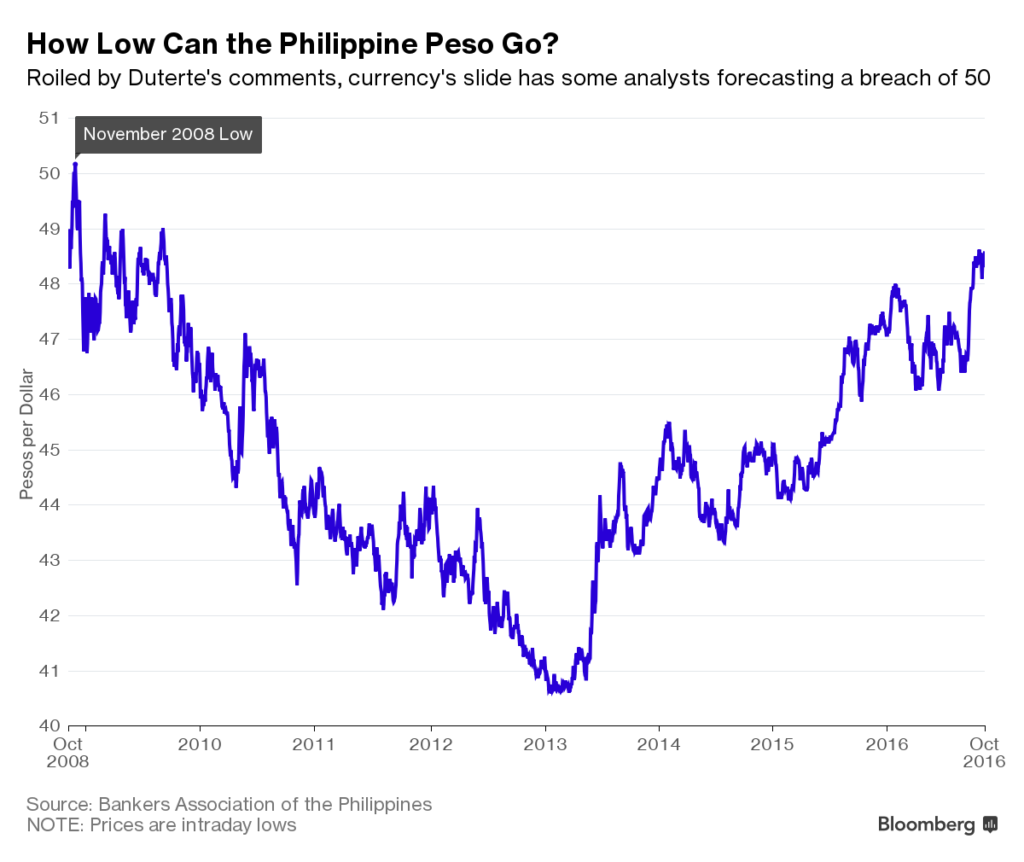

This risks worsening the already tense situation around the South China sea. If taken seriously, such a drastic change could have deep ramifications, some positive and others negative. The stock markets and the Philippine peso have reversed course. All gains on the PSEi since the election of Mr Duterte have been erased, and the peso is at a seven-year low. This is perhaps more the result of how unstable and obscure Mr Duterte’s policy seems to be, rather than an actual reassessment of the Philippine’s economy.

Duterte’s position appears to be more guided by anti-American feelings than by any belief in a rapprochement with China. His wish to maintain strong economic cooperation with Japan, still the country’s biggest trade partner, is quite clearly at loggerheads with befriending China and cutting ties with the US.

Though badly executed, President Duterte’s policies could make his country more attractive to Chinese FDI, which amounted to only 1.4 percent of total FDI in 2015. Chinese businesses are known to be sensitive to the decisions of their political leaders, and tend to limit their investment in countries not on good terms with Beijing. A state-trip to China at the end of October has already reaped some benefit, with China offering a $9bn low-interest loan and $15bn in investment projects.

This could potentially help President Duterte’s intention in raising infrastructure spending from 5 percent of GDP under his predecessor to 7 percent. With GDP in 2015 at $292bn, a two percentage point raise over six years – the length of a presidential mandate in the Philippines – would require an additional $6bn per years, totalling spending in excess of $29bn over his term. Chinese money and Chinese tourists, who represent only 10 percent of all incoming tourists behind South Koreans, Americans and Japanese, could provide a much-needed lifeline for more money. This is assuming of course that Mr Duterte’s declarations are seen as credible to investors and not just as simple bravado.

Bibliography

• Phil Zabriskie (July 19, 2002). “The Punisher”. TIME.com

• Bloomberg data – http://www.bloomberg.com/news/articles/2016-11-01/duterte-seen-talking-peso-beyond-50-level-reached-in-2008-crisis

• http://blogs.reuters.com/breakingviews/2016/10/21/philippines-u-s-goodbye-can-fix-china-fdi-gap/

• http://www.breakingviews.com/considered-view/philippines-u-s-goodbye-can-fix-china-fdi-gap/

• http://www.philstar.com/business/2016/08/15/1613736/duterte-admin-spend-p7t-infra-next-6-years