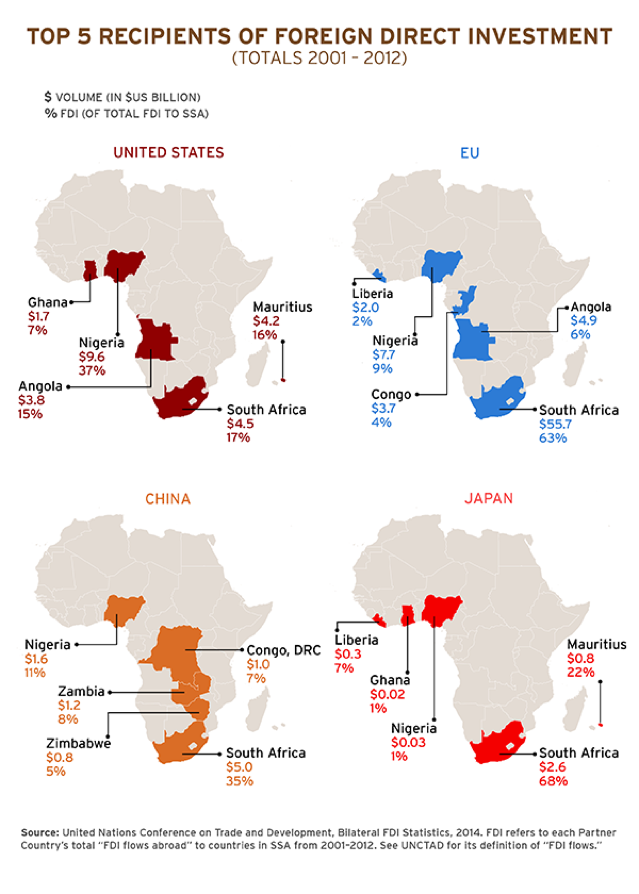

Africa has always seemed to be lagging behind the rest of the world since the colonial era and not many paid attention to African economies until recently when there was a demographic shift and the continent boasted the youngest continental population. Africa is the continent that will skip the brick and mortar development and advanced off the technological advancements of our day and age. The continent is seen by some larger emerging economies such as India and China as a sort of ‘final frontier’ in the hunt for natural resources however for others it is becoming clearer that by 2050, Africa will be one of the largest markets in the world with a significant middle class and a thirst for consumerism. To this day, foreign investment in Africa has always skewed toward resource-rich states such as South Africa (oil and gold), Nigeria (oil) and Angola (oil) whereas the rest of the continent has been overly reliant of aid and loans to finance their development. However, since the early 2000s there was a shift in the sectors that drew investment and the have been brighter prospects than just natural resources as Africans harnessed to power of tech to put themselves on the map.

Conventionally, numerous firms had been resistant to entering the African market as it did not seem to be able to support consumer goods however the Chinese broke into this market and have taken all but full control of some key industries on the continent. One particular example is the impact of Chinese media and mobile companies that have achieved a huge deal in terms of soft power in Africa. Stations such as CCTV and subscriptions such as StarTimes are very cheap and deeply integrated into the local market, the use of translations and closed captions is allowing locals to interact with Chinese content drawing them away from the West. This is key in sculpting the investment field as more people tend to engage with what they know and understand as opposed to what seems foreign. With regard to mobile phones, Chinese firms such as Huawei, Tecno and Oppo flooded the markets with cheaper alternatives to Apple, Samsung and the likes that are more suited to the needs and affordability of the domestic populations. These factors led to increased investment from Chinese firms to establish offices in African countries, to set up trade links and to venture into research and development on the continent. This marked a shift from the more detached approach used prior to 2010 where investors loosely engaged with the continent through mutual funds and exchange-traded funds (ETFs) that barely encompassed the continent.

Over the past decade, many African countries have pushed for rapid economic development that is driven by growing markets and centred on infrastructure development. The development of ports, airports, railways and highways are integral to establish a functioning interconnectivity across the continent that will make the rest of the world see the continent as a huge single bloc to be penetrated as opposed to small scattered markets that are not worth pursuing. The strong pan-African ideals and the resurgence of the African Union have played an important role in the development of agreements that point towards unity and the development of a unified continent through the removal of barriers between states that are colonial remnants. The African Union is working on an ambitious Agenda 2063 that seeks to unify Africa with a single e-passport, a continental free trade area and potentially a single currency. The first two seem likely in the next decade while the latter still seems to be a hope for the future. The indication to investors, however, is the removal of barriers, is an opportunity to access 54 countries through a single market and to utilise the prime labour available on the continent. The prospects of free movement of people, goods and services across the continent is reason in itself to look toward Africa as a vital investment destination.

Outside of the so-called ‘macro’ issues the major cause for interest on the continent arises from tech. This comes in the form of digital entrepreneurship, financial technology, cyber security and artificial intelligence. The tech landscape across Africa is booming as the development of Hub cities such as Lagos, Nairobi, Kigali, Johannesburg and Casablanca have demonstrated the impact fr investment as well as reiterated the external interest for the industry to incubate and grow. The household use of mobile money systems has many investors excited as Africa somehow managed to bring millions onto the grid through mobile banking systems whilst they had never interacted with conventional banks hence African countries are skipping a major hurdle that Asian emerging economies struggled with by establishing the wealth of a state accurately as part of the formal economy. This increased transparency of the financial flows within the country are being made possible through tech innovation and have positive implications for the governance aspect as this allows for better distribution of public services and better collection of dues such as taxes that will be critical to allow governments to effectively manage the structures necessary to foster the thriving tech and business environments. Moreover, the widespread use of mobile technology is leading to the development of huge tech based industries such as app based logistics and delivery firms, mobile money firms that bank and lend, domestic social networks and even betting applications.

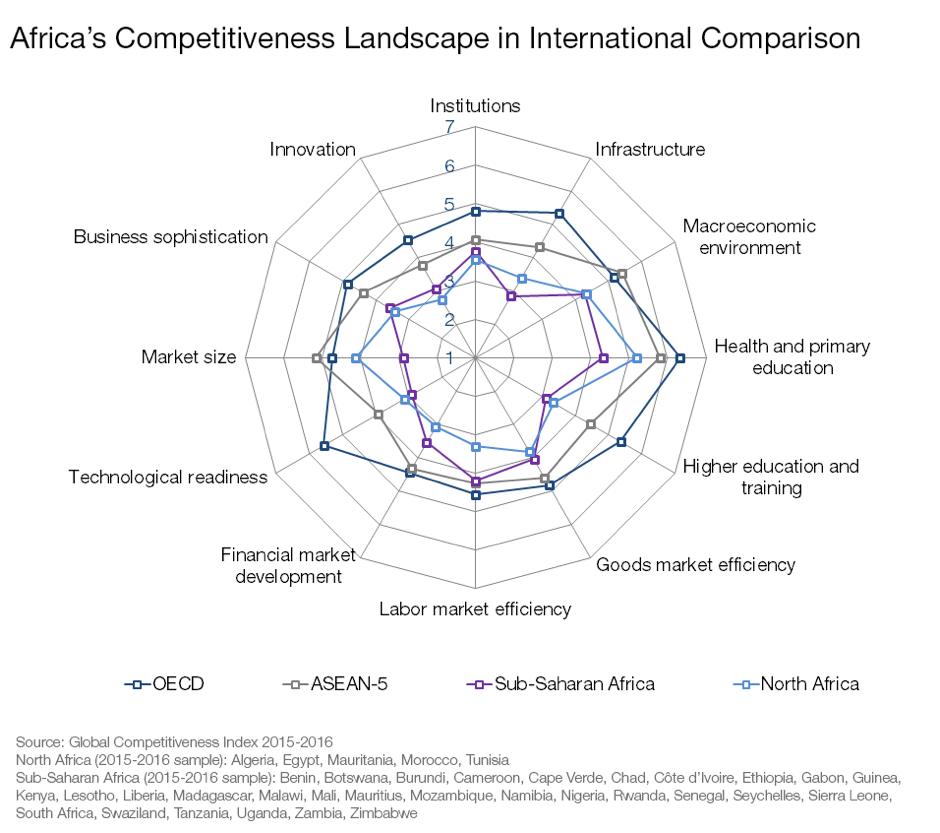

Lastly, outside of the new and exciting developments on the continent the demographics will play an important role in the future of investment on the continent. Africa will be the last major low-wage region in the world and will presumably takeover the role that Asia held for the past few decades of handling mass manufacturing as the natural shift of these industries has begun with China and India outsourcing some of their production to Africa already. The stagnation of economies in the OECD also make Africa a more suitable playing ground for investments as there is more potential for high yields in the coming years as the risks continue to be mitigated by the strengthening of institutions and the development of the economy, soon enough Africa will be able to go toe-to-toe for investment with any other region in the world. UNCTAD demonstrated that Africa had the highest rate of return on inflows of FDI between 2009 and 2011 and this is just the beginning. DR Congo and South Africa hold significant reserves for cobalt and platinum respectively that are key materials for use in electronic devices, Kenya and Morocco and Senegal sit strategically as entry points into the continent, Mauritius and Nigeria are behemoths of financial flow and storage in Africa and overall potential for renewable energy across the deserts of the continent is unimaginable. Africa is the future, the investments will no doubt come to the continent as the time is now. One article cannot suffice to vividly portray the opportunities or the mere reasons why one should believe the hype but hopefully this article has shown that there is something special brewing in Africa.

References

Collier, P. (2019). The case for investing in Africa. [online] McKinsey & Company. Available at: https://www.mckinsey.com/featured-insights/middle-east-and-africa/the-case-for-investing-in-africa [Accessed 5 Mar. 2019].

Kuepper, J. (2019). How to Invest in Africa, “The Final Frontier”. [online] The Balance. Available at: https://www.thebalance.com/how-to-invest-in-africa-1979046 [Accessed 5 Mar. 2019].

Odusola, A. (2019). Why investing in Africa is sound business and a sustainable corporate strategy | UNDP in Africa. [online] UNDP. Available at: http://www.africa.undp.org/content/rba/en/home/blog/2018/why-investing-in-africa-is-sound-business-and-a-sustainable-corp.html [Accessed 5 Mar. 2019].

Odusola, A. (2019). Why the best time to invest in Africa is now!. [online] New African Magazine. Available at: https://newafricanmagazine.com/news-analysis/businesseceonomy/why-the-best-time-to-invest-in-africa-is-now/ [Accessed 5 Mar. 2019].

Smith, N. (2019). Bloomberg – Are you a robot?. [online] Bloomberg.com. Available at: https://www.bloomberg.com/opinion/articles/2018-09-21/africa-economy-west-should-try-to-match-chinese-investment [Accessed 5 Mar. 2019].

Sow, M. (2019). Figures of the week: Chinese investment in Africa. [online] Brookings. Available at: https://www.brookings.edu/blog/africa-in-focus/2018/09/06/figures-of-the-week-chinese-investment-in-africa/ [Accessed 5 Mar. 2019].

Sultan al Essa, T. (2019). 6 reasons to invest in Africa. [online] World Economic Forum. Available at: https://www.weforum.org/agenda/2016/05/6-reasons-to-invest-in-africa/ [Accessed 5 Mar. 2019].